Question #9 for 2023: What will happen with house prices in 2023?

Earlier I posted some questions on my blog for next year: Ten Economic Questions for 2023. Some of these questions concern real estate (inventory, house prices, housing starts, new home sales), and I’ll post thoughts on those in the newsletter (others like GDP and employment will be on my blog).

I'm adding some thoughts, and maybe some predictions for each question.

9) House Prices: It appears house prices - as measured by the national repeat sales index (Case-Shiller, FHFA, and CoreLogic) - will be up around 7% in 2022. What will happen with house prices in 2023?

The first question I’m always asked is what “Will happen with house prices?”. No one has a crystal ball, but it does appear house prices will decline in 2023.

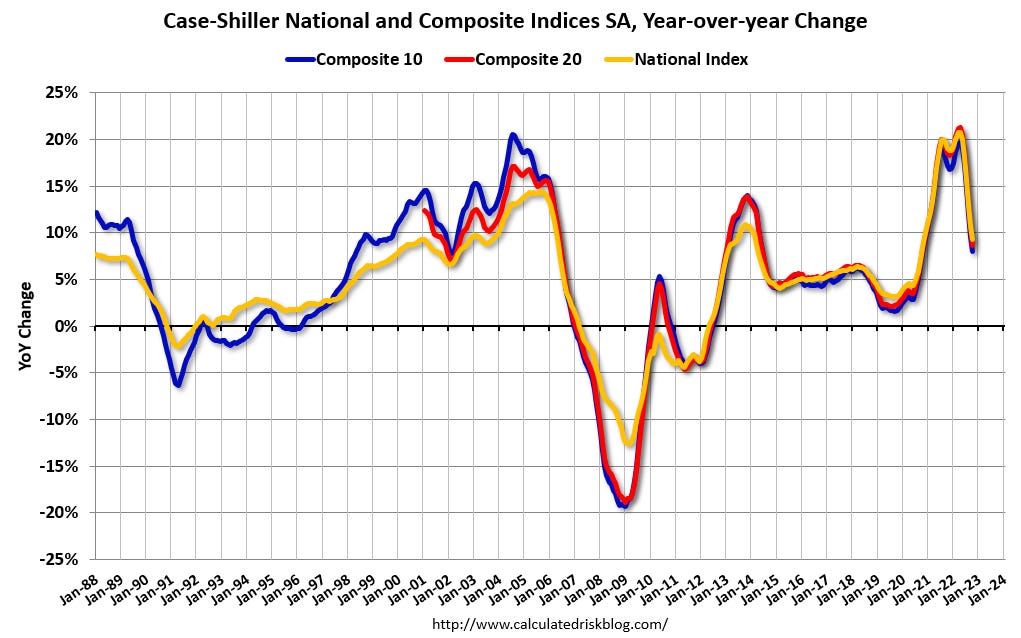

The following graph shows the year-over-year change through October 2022, in the seasonally adjusted Case-Shiller Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000). The Case-Shiller Home Price Indices for “October” is a 3-month average of August, September and October closing prices. August closing prices include some contracts signed in June, so there is a significant lag to this data.

The Composite 10 index was down 0.5% in October (SA) and down 3.8% from the recent peak in June 2022. The Composite 20 index was down 0.5% (SA) in October and down 3.8% from the recent peak in June 2022. The National index was down 0.3% (SA) in October and is down 2.4% from the peak in June 2022.

Here is a graph of the month-over-month (MoM) change in the Case-Shiller National Index Seasonally Adjusted (SA).

The Case-Shiller National Index (SA) has declined for four consecutive months. These were the first seasonally adjusted declines in this index since early 2012.

Although I mostly use Case-Shiller, I also follow several other price indexes. The following table shows the year-over-year change for several house prices indexes. This also shows the timing of the recent peak, indicating how quickly the indexes have decelerated.

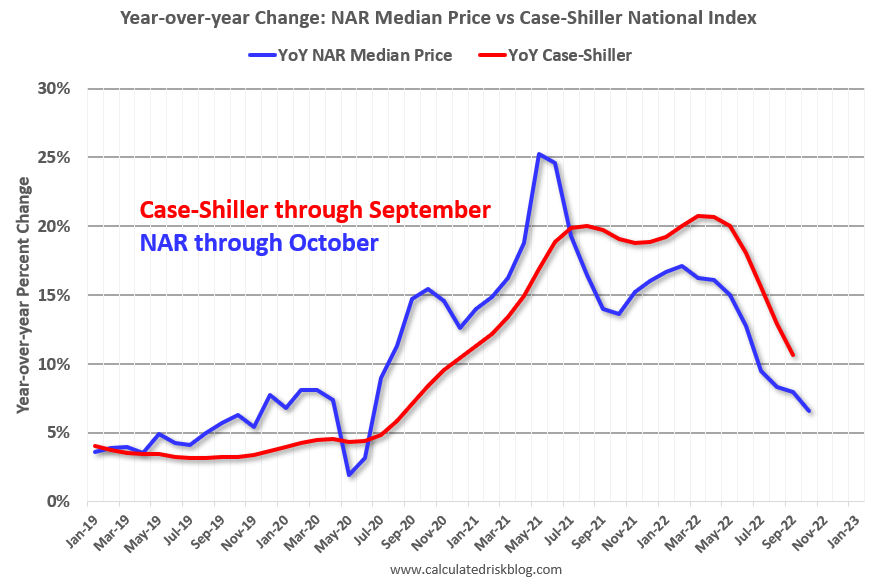

The following graph - as of the NAR release last month - shows that Case-Shiller followed the median prices up and is now following the deceleration in median prices down. It is likely the median price will be down year-over-year in a few months - and Case-Shiller will follow.

Note: Median prices are distorted by the mix (repeat sales indexes like Case-Shiller and FHFA are probably better for measuring prices).

There are a wide range of price forecasts for 2022, from around 5% YoY growth to as much as a double-digit percentage decline.

Keep reading with a 7-day free trial

Subscribe to CalculatedRisk Newsletter to keep reading this post and get 7 days of free access to the full post archives.