The rental market has changed significantly.

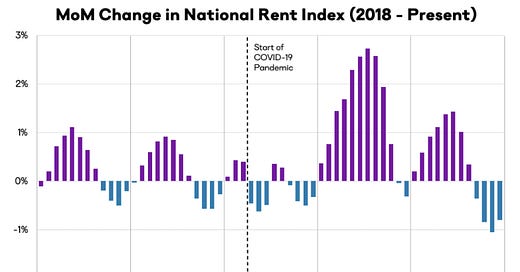

Rental Data shows Faster Decline than "Seasonality Alone"

From ApartmentList.com: Apartment List National Rent Report

Welcome to the first Apartment List National Rent Report of 2023. Our national index fell by 0.8 percent over the course of December, marking the fourth straight month-over-month decline. The tim…

Keep reading with a 7-day free trial

Subscribe to CalculatedRisk Newsletter to keep reading this post and get 7 days of free access to the full post archives.