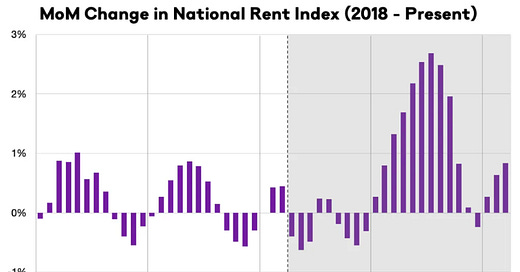

Rents Still Increasing Sharply Year-over-year

Higher Rents will impact measures of inflation in 2022

From ApartmentList.com: Apartment List National Rent Report

Welcome to the April 2022 Apartment List National Rent Report. Rent growth is continuing to pick up steam again, after a brief winter cooldown, with our national index up by 0.8 percent over the course of March. So far this year, rents are growing more slowly than they did in 2021, but faster th…

Keep reading with a 7-day free trial

Subscribe to CalculatedRisk Newsletter to keep reading this post and get 7 days of free access to the full post archives.