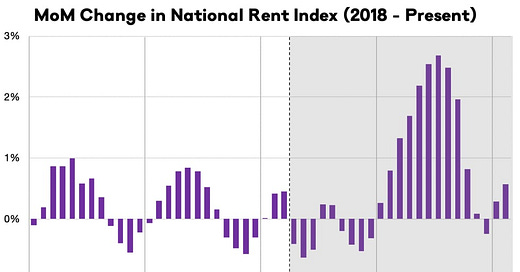

Rents Still Increasing Sharply Year-over-year

Higher Rents will impact measures of inflation in 2022

From ApartmentList.com: Apartment List National Rent Report

After a slight seasonal cooldown over the past few months, rent growth is back on an upward trajectory, with our national index up by 0.6 percent over the course of February. Even though month-over-month rent growth has moved back into positive territory, it remains substantially cooler than las…

Keep reading with a 7-day free trial

Subscribe to CalculatedRisk Newsletter to keep reading this post and get 7 days of free access to the full post archives.