Single Family Starts Up 22% Year-over-year in March; Multi-Family Starts Down Sharply

Housing Starts Decreased to 1.321 million Annual Rate in March

Housing Starts Decreased to 1.321 million Annual Rate in March

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately‐owned housing starts in March were at a seasonally adjusted annual rate of 1,321,000. This is 14.7 percent below the revised February estimate of 1,549,000 and is 4.3 percent below the March 2023 rate of 1,380,000. Single‐family housing starts in March were at a rate of 1,022,000; this is 12.4 percent below the revised February figure of 1,167,000. The March rate for units in buildings with five units or more was 290,000.

Building Permits:

Privately‐owned housing units authorized by building permits in March were at a seasonally adjusted annual rate of 1,458,000. This is 4.3 percent below the revised February rate of 1,523,000, but is 1.5 percent above the March 2023 rate of 1,437,000. Single‐family authorizations in March were at a rate of 973,000; this is 5.7 percent below the revised February figure of 1,032,000. Authorizations of units in buildings with five units or more were at a rate of 433,000 in March.

emphasis added

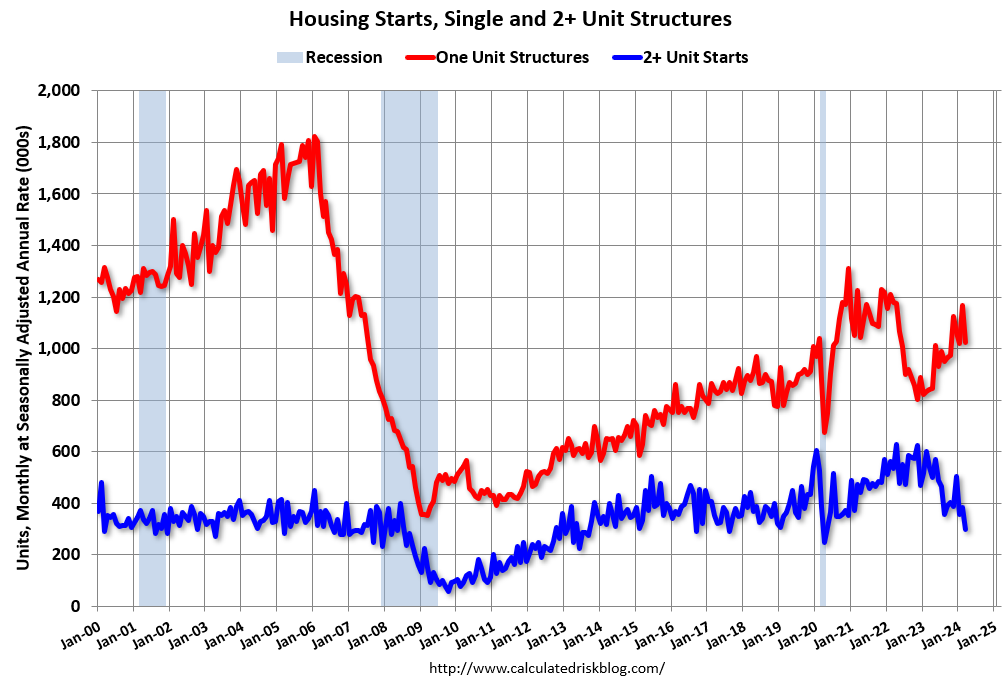

The first graph shows single and multi-family housing starts since 2000 (including housing bubble).

Multi-family starts (blue, 2+ units) decreased in March compared to February. Multi-family starts were down 44.3% year-over-year in March. Single-family starts (red) decreased in March and were up 21.2% year-over-year.

Note that the weakness in 2022 and early 2023 had been in single family starts (red), however the weakness has moved to multi-family now while single family has bounced back from the bottom.

The second graph shows single and multi-family starts since 1968. This shows the huge collapse following the housing bubble, and then the eventual recovery - and the recent collapse and now recovery in single-family starts.

Total housing starts in March were well below expectations, however, starts in January and February were revised up.

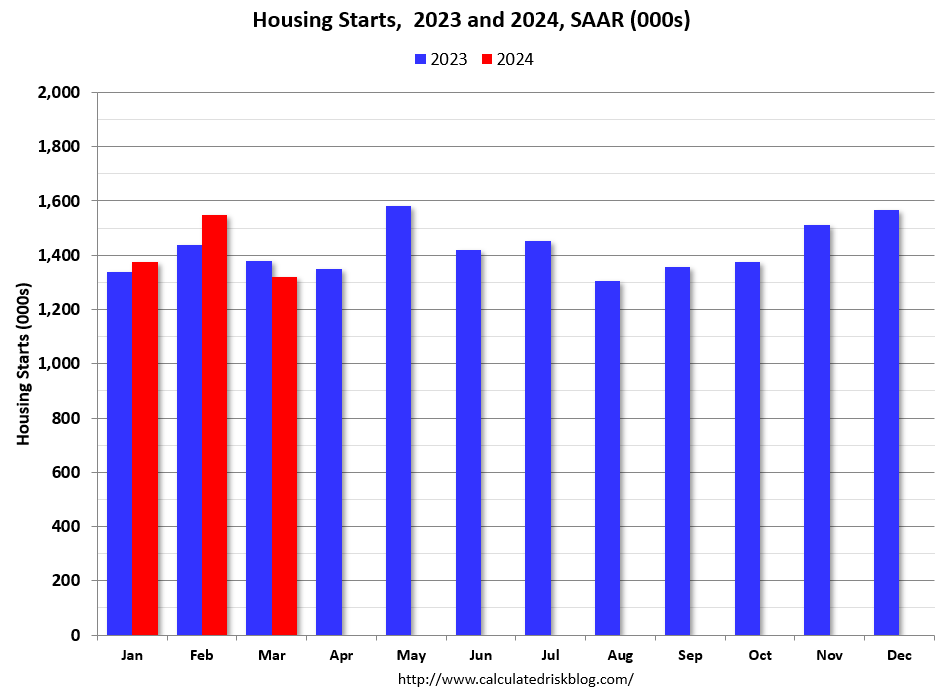

The third graph shows the month-to-month comparison for total starts between 2023 (blue) and 2024 (red).

Total starts were down 4.3% in March compared to March 2023.

Starts were down year-over-year (YoY) in March following 4 consecutive months with starts up YoY. The YoY decline is due to the sharp decrease in multi-family starts.

Multi-Family Housing Units Under Construction has Peaked

Keep reading with a 7-day free trial

Subscribe to CalculatedRisk Newsletter to keep reading this post and get 7 days of free access to the full post archives.