Slowdown in Showings, Sharp Decline in California Pending Sales, Inventory Surges

Housing Economist Tom Lawler's May Existing Home Projection

There are three items in this note:

Housing economist Tom Lawler’s May existing home projection

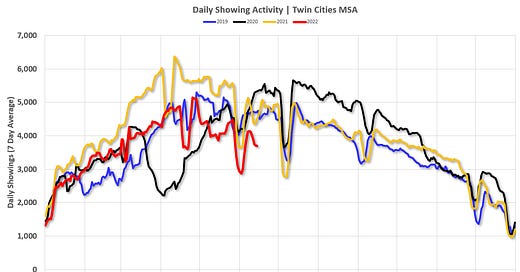

Slowdown in Showings in the Twin Cities

A Sharp Decline in Pending Sales in California, Inventory Surges

Early Read on Existing Home Sales in May

From housing economist Tom Lawler:

Based on publicly-available local realtor/MLS reports released across the country th…

Keep reading with a 7-day free trial

Subscribe to CalculatedRisk Newsletter to keep reading this post and get 7 days of free access to the full post archives.