'Some prospective buyers took a break'

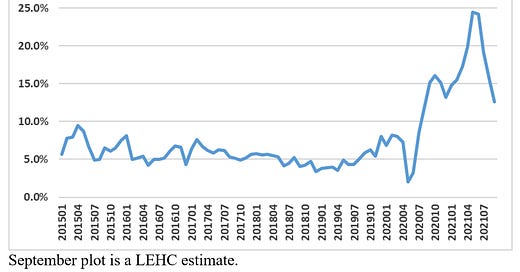

Existing Home Sales forecast, and adding Boston, Indiana, Rhode Island, and Washington D.C. September Data

Lawler: Early Read on Existing Home Sales in September

Housing economist Tom Lawler has been sending me his predictions of what the NAR will report for over 11 years. Lawler hasn't always been closer than the consensus, but usually when there has been a fairly large spread between Lawler's estimate and the "consensus", Lawler has been closer.

This month -…

Keep reading with a 7-day free trial

Subscribe to CalculatedRisk Newsletter to keep reading this post and get 7 days of free access to the full post archives.