Supply Chain Disruptions and Housing Inventory

Last week I noted that currently there were the most housing units under construction since 1973. I’ve been wondering if the supply chain issues are impacting existing home inventory (and also rental vacancy rates).

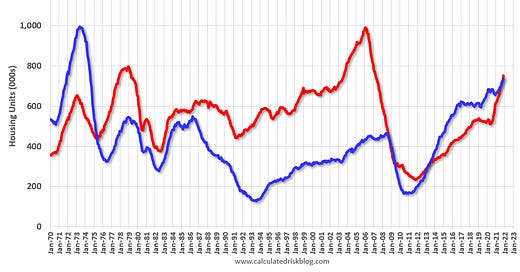

This graph shows housing starts under construction, Seasonally Adjusted (SA).

Red is single family units. Currently there are 752 thousand…

Keep reading with a 7-day free trial

Subscribe to CalculatedRisk Newsletter to keep reading this post and get 7 days of free access to the full post archives.