During the housing bubble, many homeowners borrowed heavily against their perceived home equity - jokingly calling it the “Home ATM” - and this contributed to the subsequent housing bust, since so many homeowners had negative equity in their homes when house prices declined.

Unlike during the housing bubble, very few homeowners have negative equity now. From CoreLogic this morning: Homeowner Equity Insights – Q1 2024

CoreLogic analysis shows U.S. homeowners with mortgages (roughly 62% of all properties*) have seen their equity increase by a total of $1.5 trillion since the first quarter of 2023, a gain of 9.6% year over year.

In the first quarter of 2024, the total number of mortgaged residential properties with negative equity decreased by 2.1% from the fourth quarter of 2023, representing 1 million homes, or 1.8% of all mortgaged properties. On a year-over-year basis, negative equity declined by 16.1% from 1.2 million homes, or 2.1% of all mortgaged properties, from the first quarter of 2023.

Refinance activity declined significantly in early 2022 as mortgage rates increased, and I was expecting MEW to also decline as fewer homeowners used cash-out refinancing. However, in mid-2022, homeowners switched to using home equity loans (2nd loans) to extract equity from their homes.

The Fed noted this increase in demand for HELOCs in the October 2022 Senior Loan Officer Opinion Survey on Bank Lending Practices: “banks reported tighter standards and stronger demand for home equity lines of credit (HELOCs).” However, in the last six quarterly surveys, the Fed noted that “banks reported tighter standards and weaker demand for home equity lines of credit (HELOCs).” emphasis added

Since demand weakened for HELOCs, and refinancing activity is off sharply, MEW turned negative in Q1 2023 and was only slightly positive in Q2 through Q4 2023, Mortgage Equity Withdrawal is an aggregate number and is a combination of homeowners extracting equity - hence the name "MEW" - and normal principal payments and debt cancellation (modifications, short sales, and foreclosures).

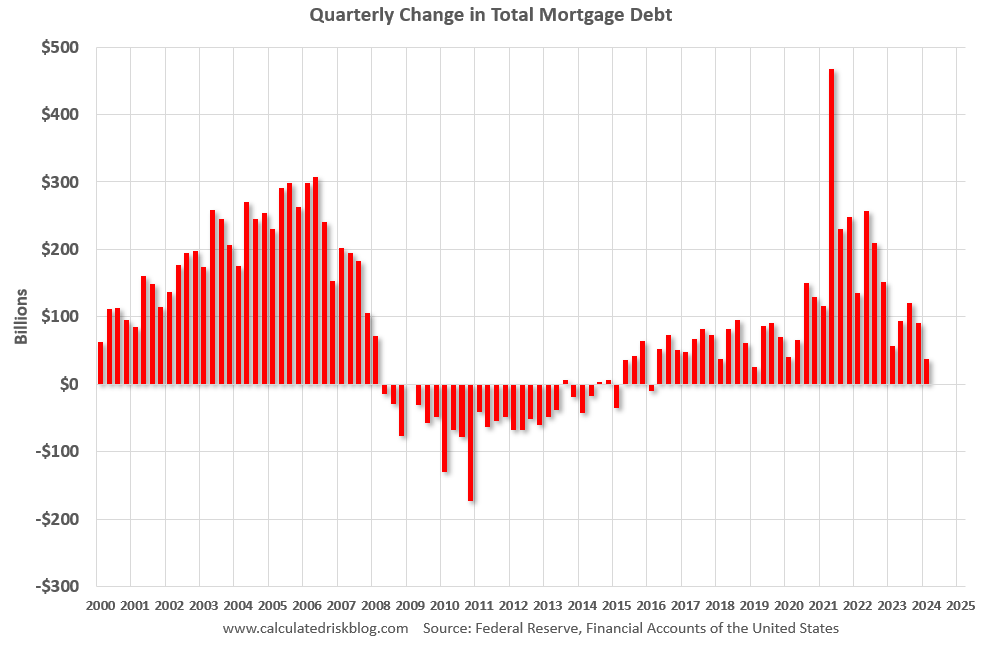

Quarterly Increase in Mortgage Debt

Here is the quarterly increase in mortgage debt from the Federal Reserve’s Financial Accounts of the United States - Z.1 (sometimes called the Flow of Funds report) released today. In the mid ‘00s, there was a large increase in mortgage debt associated with the housing bubble.

In Q1 2024, mortgage debt increased $38 billion, down from $91 billion in Q4, and down from the cycle peak of $467 billion in Q2 2021. Note the almost 7 years of declining mortgage debt as distressed sales (foreclosures and short sales) wiped out a significant amount of debt.

However, some of this debt is being used to increase the housing stock (purchase new homes), so this isn’t all Mortgage Equity Withdrawal (MEW).

Mortgage Debt as a Percent of GDP

The second graph shows household real estate assets and mortgage debt as a percent of GDP. Note this graph was impacted by the sharp decline in Q2 2020 GDP.

Mortgage debt is up $2.38 trillion from the peak during the housing bubble, but, as a percent of GDP is at 46.3% - down from Q4 - and down from a peak of 73.3% of GDP during the housing bust. This means most homeowners have large equity cushions in their home.

The value of real estate, as a percent of GDP, increased in Q1 - but is below the peak in Q2 2022, and is well above the average of the last 30 years.

ICE Mortgage Monitor on Equity Withdrawal

ICE estimated equity withdrawal in their June Mortgage Monitor. From ICE:

▪ As reported in our May Mortgage Monitor report, mortgage holders had $16.9T in equity entering Q2 2024, of which $11T could be borrowed against while maintaining a 20% equity cushion both record highs

▪ However, higher interest rates are making homeowners reluctant to borrow against that equity due to the elevated cost to do so

▪ Overall, a combined $37.5B in equity was withdrawn in Q1 via cash-out refinances ($17.5B) and second lien home equity loans/lines of credit ($20B), down slightly from in $38B in Q4 2024.

▪ Historically, home equity withdrawals especially second lien extractions hit seasonal lows in Q4 /Q1 before seasonal rises in the spring and summer months

Calculated Risk Estimate of MEW

Keep reading with a 7-day free trial

Subscribe to CalculatedRisk Newsletter to keep reading this post and get 7 days of free access to the full post archives.