When will House Price Growth Slow?

The Case-Shiller National Index will probably show record year-over-year growth in April

Most analysts expect house price growth to slow sharply in coming months. For example, a few weeks ago, I wrote: What will Happen with House Prices?

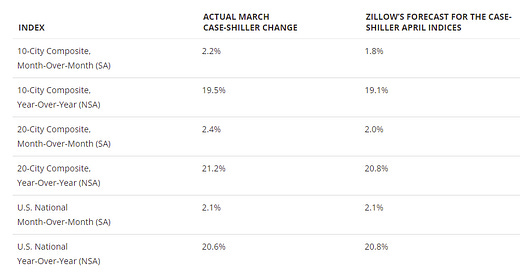

However, the most recent Case-Shiller report showed house prices were up a record 20.6% year-over-year (YoY). This report was for March (a three-month average of January, February and March prices).

And, a…

Keep reading with a 7-day free trial

Subscribe to CalculatedRisk Newsletter to keep reading this post and get 7 days of free access to the full post archives.