Note: I mentioned this last year, but it is worth updating since different measures of inventory show significantly different year-over-year increases.

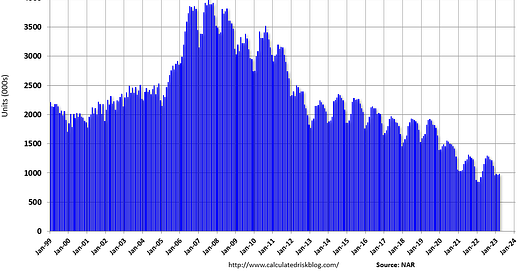

Yesterday the National Association of REALTORS® (NAR) reported that inventory was up 5.4% year-over-year:

Total housing inventory registered at the end of March was 980,000 units, up 1.0% from February and…

Keep reading with a 7-day free trial

Subscribe to CalculatedRisk Newsletter to keep reading this post and get 7 days of free access to the full post archives.