Freddie Mac House Price Index Up 1.0% Year-over-Year in October

Punta Gorda House Prices Down Over 20% from Recent Peak, Austin Down over 17%

Note: The Freddie Mac index is a repeat sales index using only loans purchased by Fannie and Freddie and includes appraisals. See FAQs here. Freddie has data for all states and many cities. For house prices, I’m currently following Case-Shiller, FHFA, CoreLogic, ICE, the NAR median prices, and this Freddie Mac index.

Freddie Mac reported that its “National” Home Price Index (FMHPI) increased 0.13% month-over-month (MoM) on a seasonally adjusted (SA) basis in October.

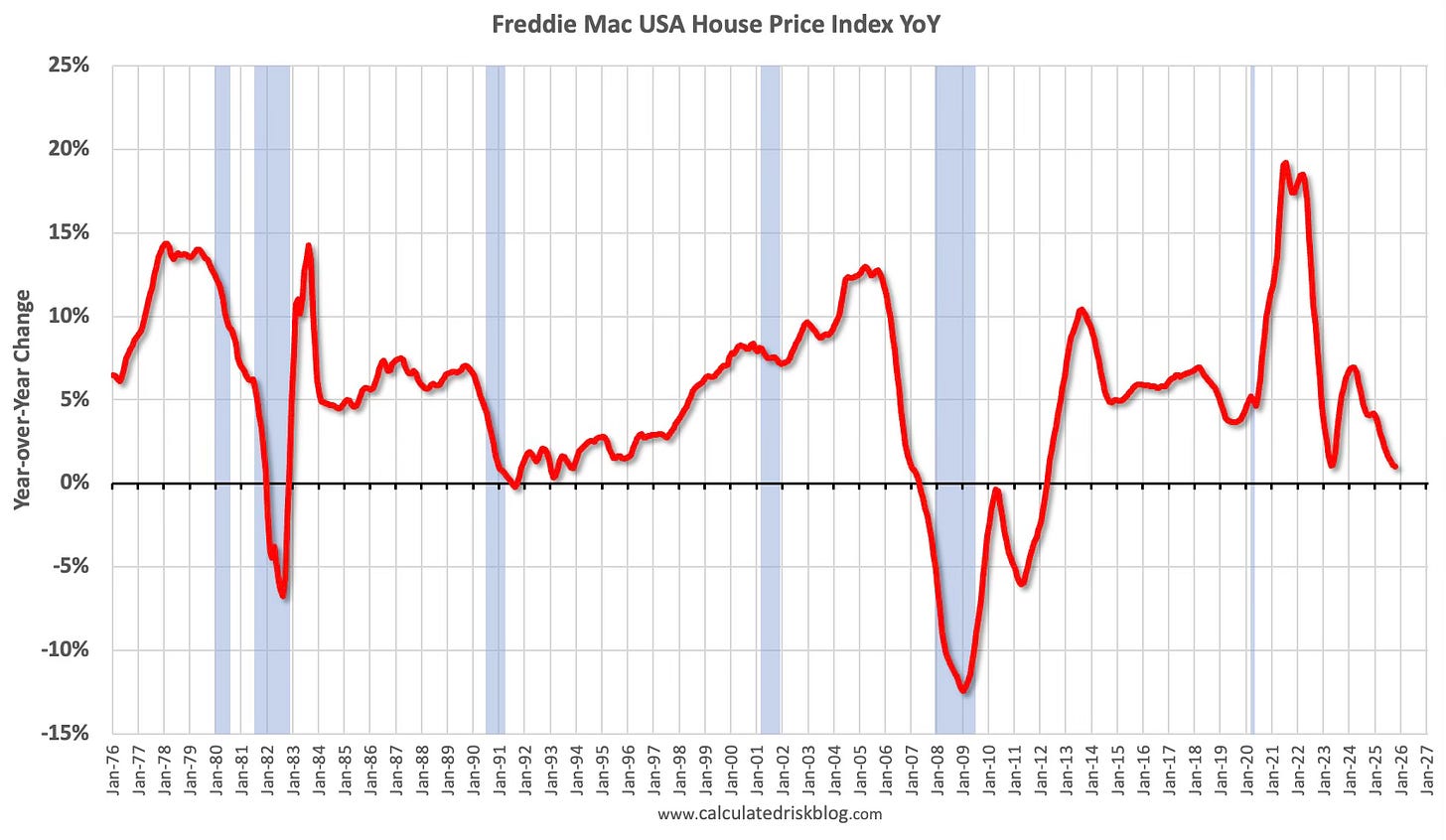

On a year-over-year (YoY) basis, the National FMHPI was up 1.0% in October, down from up 1.1% YoY in September. The YoY increase peaked at 19.2% in July 2021, and for this cycle, and previously bottomed at up 1.1% YoY in April 2023. The YoY change in October is a new cycle low.

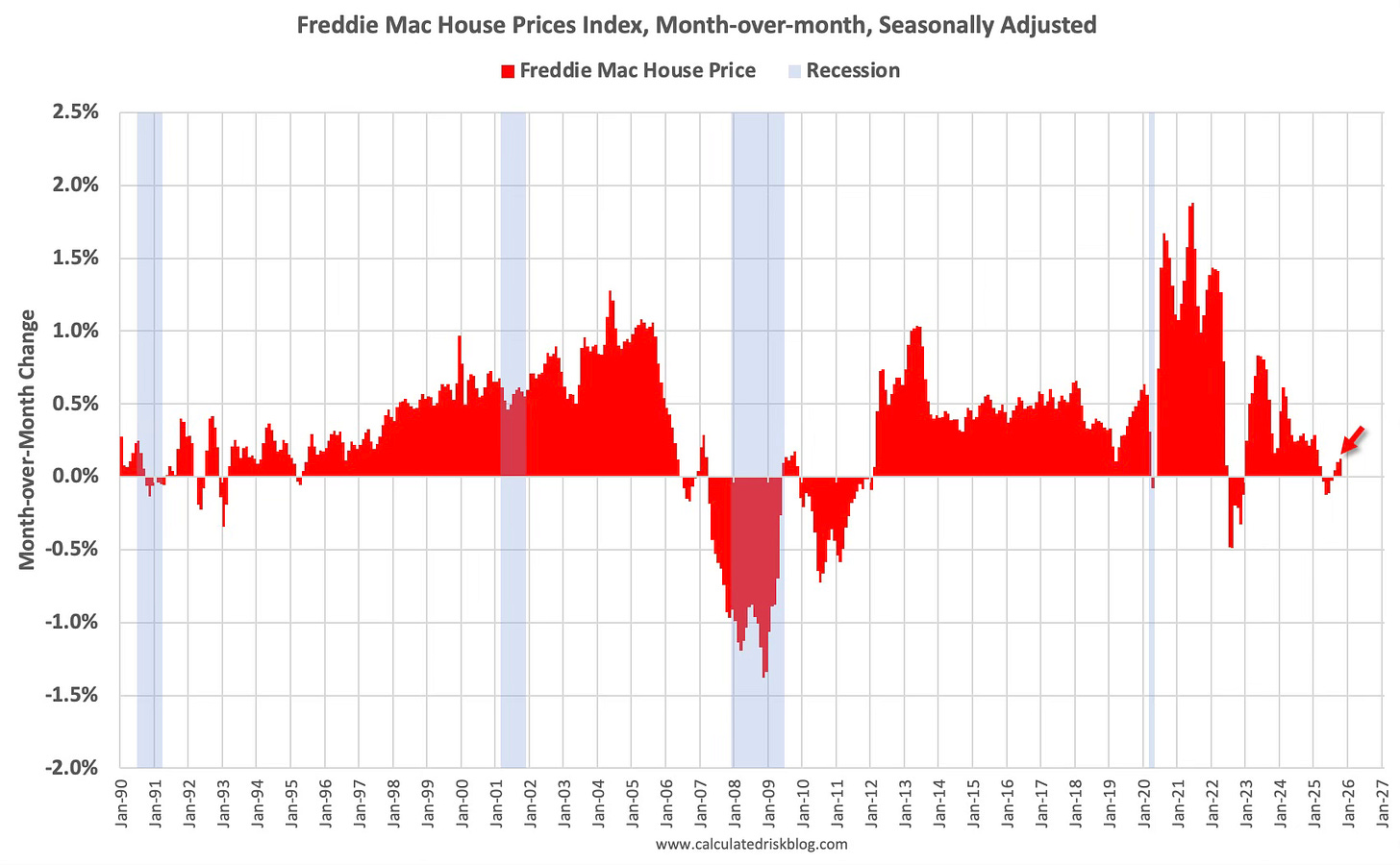

The second graph shows the month-over-month (MoM) change in the national FMHPI, seasonally adjusted.

The seasonally adjusted FMHPI increased 0.13% MoM on a seasonally adjusted (SA) basis in October. Over the last 3 months, this index has increased at a 1.1% annual rate and is up at a 0.1% annual rate over the last 6 months.

House prices are under pressure and might turn negative year-over-year by the end of 2025.

26 States and D.C. have seen price declines Seasonally Adjusted

As of October, 26 states and D.C. were below their previous peaks, Seasonally Adjusted. The largest seasonally adjusted declines from the recent peaks are in D.C. (-3.2%), Florida (-3.0%) and Texas (-2.5%).

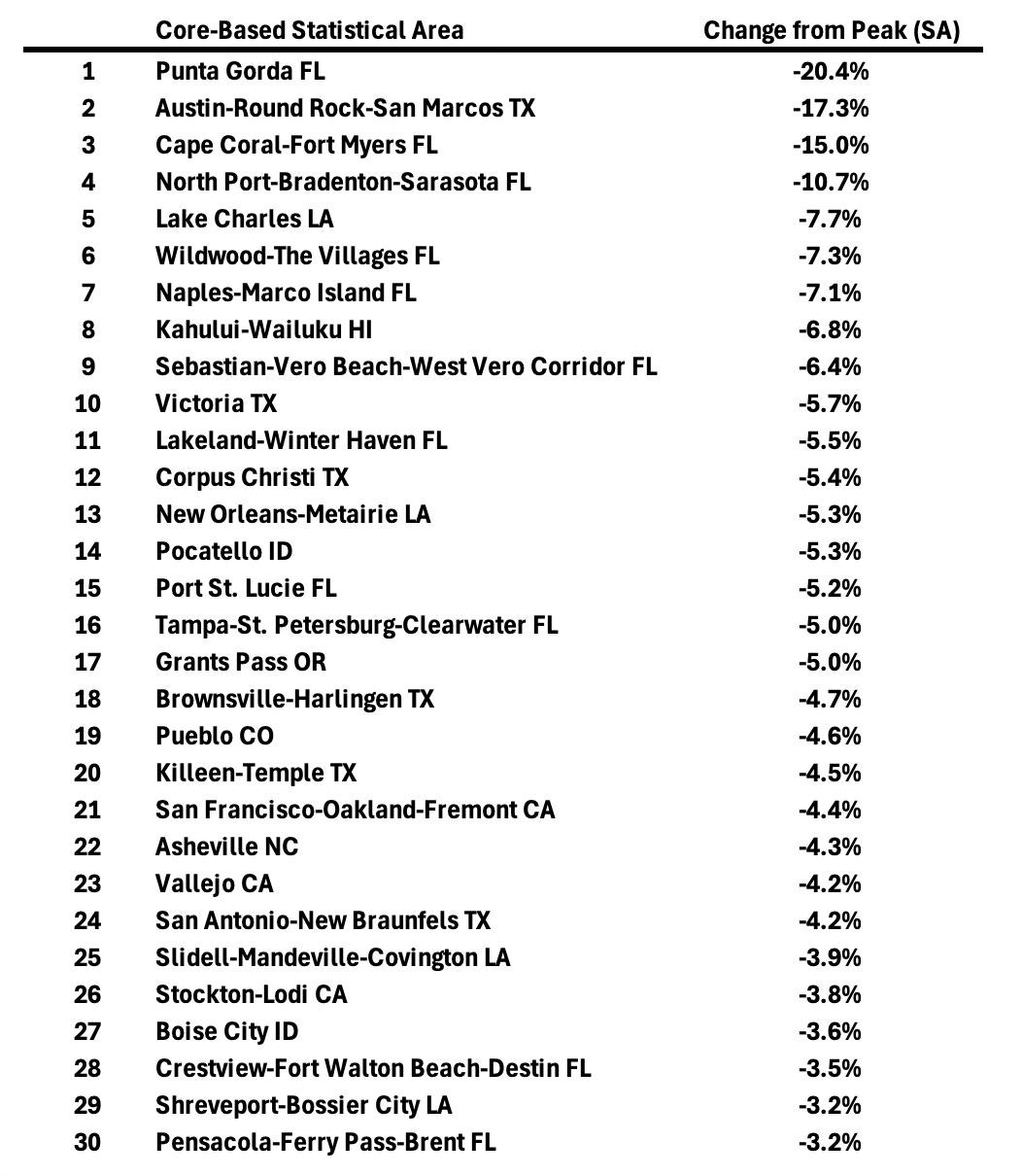

For cities (Core-based Statistical Areas, CBSA), 200 of the 387 CBSAs are below their previous peaks.

Here are the 30 cities with the largest declines from the peak, seasonally adjusted. Punta Gorda has passed Austin as the worst performing city. Note that 5 of the 7 cities with the largest price declines are in Florida.

Florida has the largest number of CBSAs on the list and Texas has the 2nd most.

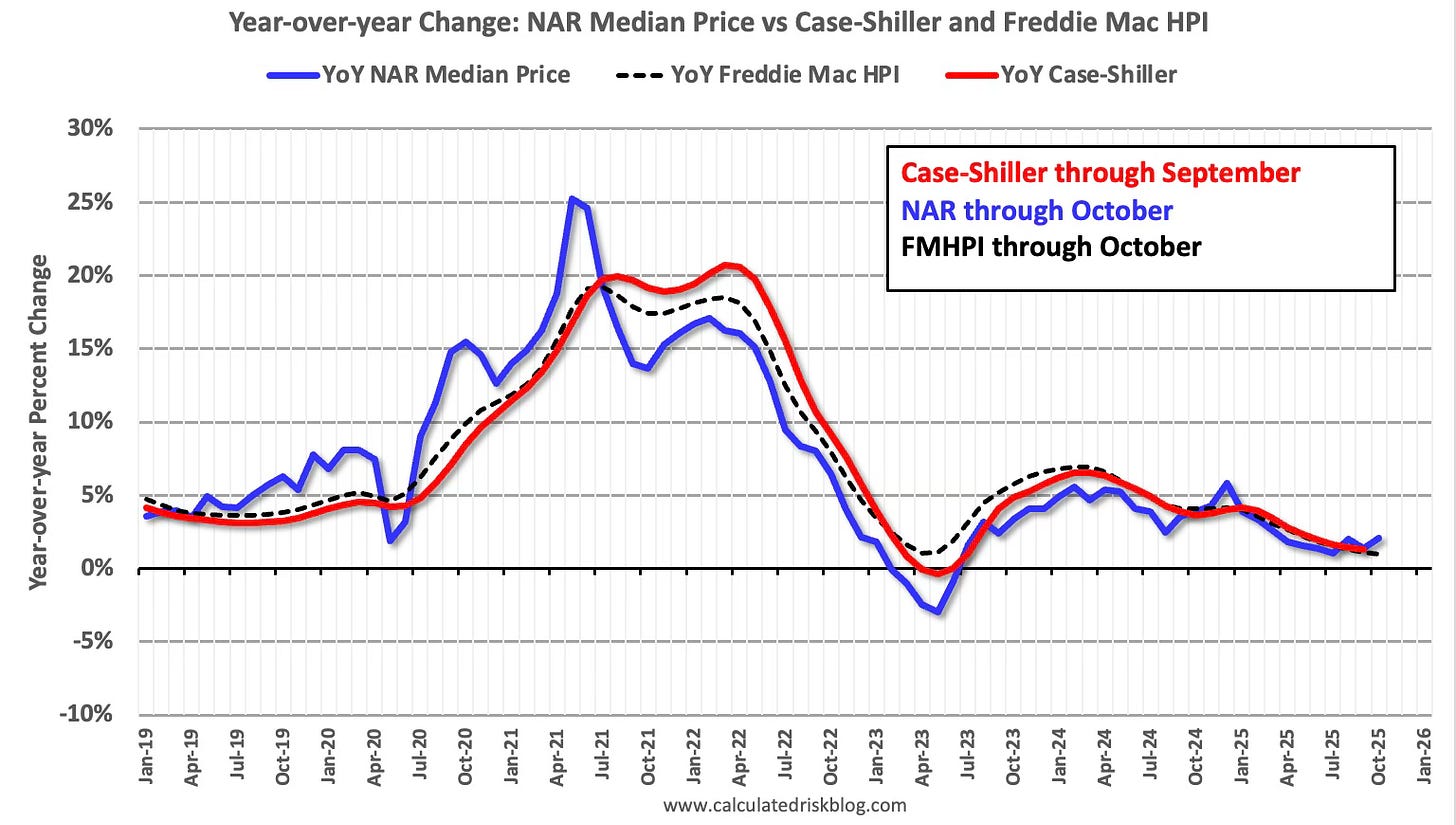

Here is a comparison of year-over-year change in the FMHPI, median house prices from the NAR, and the Case-Shiller National index.

The FMHPI and the NAR median prices (up 2.1% YoY in October) appear to be leading indicators for Case-Shiller. The Case-Shiller index was up 1.3% YoY in September. The FMHPI is suggesting the Case-Shiller index will likely be up about the same year-over-year in the October report compared to September.

Since inventory has increased in 2025, while sales remained low, house price growth (year-over-year) has slowed and might turn negative towards the end of 2025.