Mortgage Rate Update

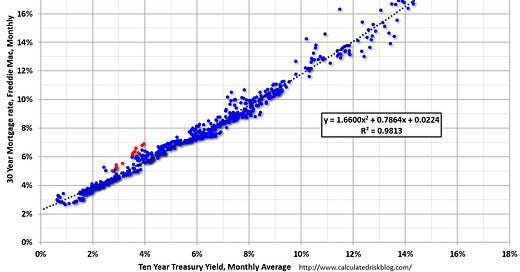

Mortgage News Daily reports that the most prevalent 30-year fixed rate is now at 6.18% for top tier scenarios. Usually there is a fairly steady spread between the ten-year Treasury yield and 30-year mortgage rates, although - as housing economist Tom Lawler explained in Mortgage/Treasury Spreads, Part I and Part II - the spread has widened due to severa…

Keep reading with a 7-day free trial

Subscribe to CalculatedRisk Newsletter to keep reading this post and get 7 days of free access to the full post archives.