Yesterday, in Part 1: Current State of the Housing Market; Overview for mid-July 2025 I reviewed home inventory, housing starts and sales. I noted that the key stories for existing homes are that inventory is increasing sharply, and sales are essentially flat compared to last year (and sales in 2024 were the lowest since 1995). That means prices are under pressure. And there are significant regional differences too.

In Part 2, I will look at house prices, mortgage rates, rents and more.

These “Current State” summaries show us where we came from, where we are, and hopefully give us clues as to where we are going!

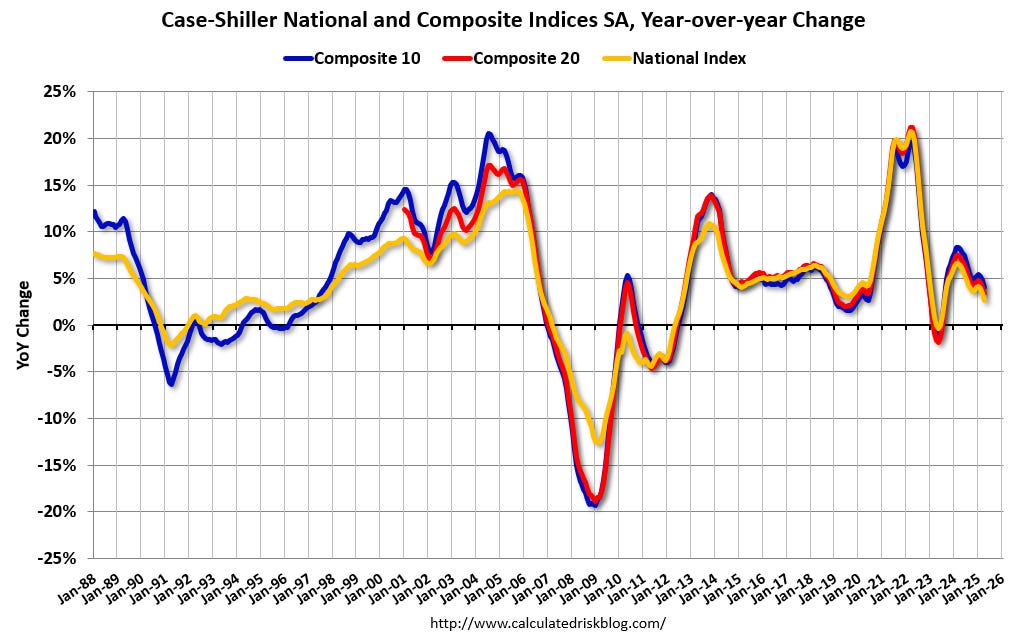

House Prices

The Case-Shiller National Index increased 2.7% year-over-year (YoY) in April and will likely be lower year-over-year in the May report compared to April (based on other data).

The Composite 10 NSA was up 4.1% year-over-year. The Composite 20 NSA was up 3.4% year-over-year. The National index NSA was up 2.7% year-over-year.

The MoM decrease in the seasonally adjusted (SA) Case-Shiller National Index was at -0.51% (a -4.8% annual rate). This was the second consecutive MoM decrease.

In the January report, the Case-Shiller National index was up 4.2%, in February up 3.9%, in March up 3.4%, and now, in the April report, up 2.7%.

And the April Case-Shiller index was a 3-month average of closing prices in February, March and April. ("April" is a 3-month average of February, March and April closing prices). February closing prices include some contracts signed in December!

Not only is this trending down, but there is a significant lag to this data.

Let’s review some more timely house price data …

The following content is for paid subscribers only. Thanks to all paid subscribers!

Keep reading with a 7-day free trial

Subscribe to CalculatedRisk Newsletter to keep reading this post and get 7 days of free access to the full post archives.