Question #9 for 2025: What will happen with house prices in 2025?

Earlier I posted some questions on my blog for next year: Ten Economic Questions for 2025. Some of these questions concern real estate (inventory, house prices, housing starts, new home sales), and I’ll post thoughts on those in this newsletter (others like GDP and employment will be on my blog).

I'm adding some thoughts and predictions for each question.

Here is a review of the Ten Economic Questions for 2024.

9) House Prices: It appears house prices - as measured by the national repeat sales index (Case-Shiller, FHFA, and Freddie Mac) - will be up 3% to 4% in 2024. What will happen with house prices in 2025?

The first question I’m always asked about housing is “What will happen with house prices?” No one has a crystal ball, and it depends on supply and demand.

Last year, I wrote about house prices in 2024:

"I don’t expect inventory to reach 2019 levels but based on the recent increase in inventory maybe more than half the gap between 2019 and 2023 levels will close in 2024. If existing home sales remain sluggish, we could see months-of-supply back to 2017 - 2019 levels.

That would likely put price increases in the 3% to 4% range in 2024. I don’t expect either a crash in prices or a surge in prices. "

The following graph shows the year-over-year change through September 2024, in the seasonally adjusted Case-Shiller Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000). The Case-Shiller Home Price Indices for "September" is a 3-month average of July, August and September closing prices. September closing prices include some contracts signed in May, so there is a significant lag to this data.

The Composite 10 SA was up 5.2% year-over-year in September. The Composite 20 SA was up 4.6% year-over-year. The National index SA was up 3.9% year-over-year. All were at new all-time highs in September.

Here is a graph of the month-over-month (MoM) change in the Case-Shiller National Index Seasonally Adjusted (SA).

The MoM increase in the seasonally adjusted (SA) Case-Shiller National Index was at 0.33% (a 4.1% annual rate), This was the 20th consecutive MoM increase in the seasonally adjusted index.

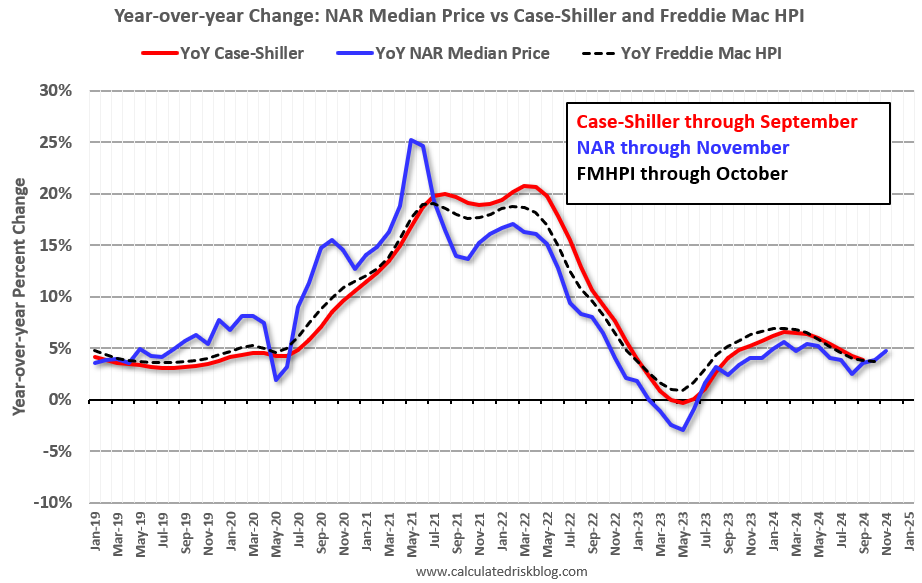

The following graph - as of the November NAR release and October Freddie Mac HPI - shows that Case-Shiller tends to follow median prices and the Freddie Mac index. The NAR median price was up 4.7% YoY in November, the Freddie Mac HPI was up 3.7% YoY in October. This suggests the YoY Case-Shiller change will remain in about the same range over the next couple of months.

Note: Median prices are distorted by the mix (repeat sales indexes like Case-Shiller and FHFA are probably better for measuring prices).

Supply and Demand are the Keys

Supply and demand are the keys for house prices; however, national house prices will mask some regional differences. We are seeing significant regional differences in supply at the end of 2024, with inventory increasing sharply in Florida and parts of Texas (and some other areas).

The following content is for paid subscribers only. Thanks to all paid subscribers!

Keep reading with a 7-day free trial

Subscribe to CalculatedRisk Newsletter to keep reading this post and get 7 days of free access to the full post archives.